Alternative Investments

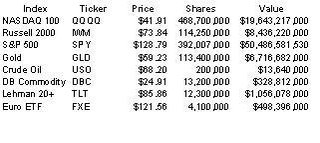

The recent run up in oil prices seems more related to investment demand and geopolitics than “economic” demand which hints that prices could be rationed and economic growth hurt. There is also a strong chance that alternative investment vehicles hurt demand for equities. The table following highlights the value of select ETFs across sectors. The gold ETF is the most successful of the non-equity ETFs followed by the Lehman 20+ year bond ETF. The gold ETF is almost as large as the Russell 200 ETF – this is a bit surprise. Notice that the oil ETF is small, and there is plenty of room for the amount of shares to expand. In other words, there is buying power on the sidelines. The crude oil ETF is only $13.6 mln in size, and there is no reason to think it cannot go to $500 mln or a billion dollars. The Deutsche Bank Fund, DBC, is also new and provides an alternative to equity shares, while having room to grow in size or steal money from stocks. It is comprised of corn, wheat, gold, aluminum, crude oil, and heating oil. Bottom line; don’t be surprised if commodities steal another few billion from the stock market, while raising commodity prices.

0 Comments:

Post a Comment

<< Home