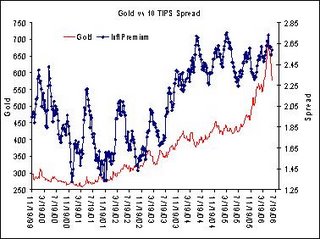

14:15: The spread between the 10 year treasury and 10 year TIPS is trading near the top end of its range, but is not accelerating. It suggests that inflation expectations are not increasing, which is a bit surprising given investor sentiment (press) and the rise in treasury yields. Note that that inflation expectations rose sharply between May 2003 and mid 2005. The move by the Fed to raise rates has checked inflation expectations, albeit at the higher end of the range. The Fed started to raise rates in mid 2004. Although the CPI and PPI highlight rising inflationary pressures, the spread does not provide dramatic confirmation. This is slightly equity friendly.

0 Comments:

Post a Comment

<< Home