The Bearish USD Catalyst

From the previous blogs, we have the bearish USD case built: the very bearish extreme on YEN and Swiss France vs USD, and the narrowing of yield spreads of USD vs European and vs Japanese Yen. The latest confirmation we have is the trendline break on the weekly closing line chart on last Friday. Right now, we want to note some catalysts market will use to speed up the downmove on USD. The US-China trade tension may be the one at the top of the list.

The calendar of events on US-China relations in the next few months is crowded. In addition to the Senators Schumer and Graham's trip this week and the potential for Congressional action on their bill, there are several other China-related initiatives in Congress also. President Hu of China will visit Wastington on Apr 24 and the US Treasury's "Currency Report" will likely be released in mid-April to May.

We have pointed out that these development are negative on USD. The US economy has benefited the most from the free flow of goods and capital, and this comparative US benefit has been reflected in healthy demand for US assets and low risk premiums. An attempt to legislate currency regimes and valuess, with a firm eye on the electoral calendar, would risk upsetting these flows.

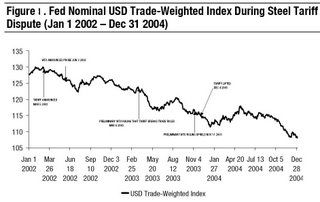

Broad-based USD weakness was seen during trade tensions that, with other factors at work, led to the US imposition of tariffs on steel products in 2002 (see chart).