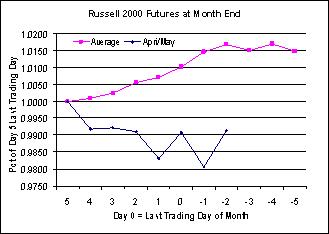

Pattern on Russell 200

14:07 Food for thought:

In recent months, the strength of the small cap sector, as defined by the Russell 2000, has been highlighted at the turn of the month. Prices typically have made a bottom five days prior to the last trading day of the month and then rallied through the first two trading days of the month. In the graphic, the turn period is defined between day 5 and day -2. Going back to January 2001, the market has finished up between day 5 and day -2 46 of 63 times (71.4% of the time). Additionally, the market was up the last 11 months, straight, during this turn period. With an hour left in yesterday’s trade, the streak was broken as Russell 2000 futures were down about 0.80% in the turn period. Whether or not this suggests future strength or weakness in the index is anyone’s guess, but it is a small change in the character of the market. Small cap shares have been up sharply over the last year – about 30%.