Story on Recession

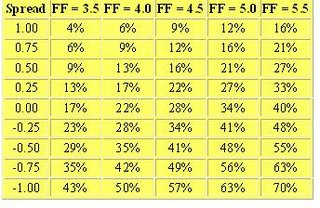

8:18: In light of the WSJ story on recession, let me take some data from a link related to the yield curve fed funds recession model from Econbrowser.com (I saved the link a number of months ago). The table is a result of Jonathon Wright, a Fed economist. The table is based on the fed funds rate and spread between the 3 month t-bill and 10 year treasury. The spread is currently +22 bps, but should likely narrow toward parity after today. The fed funds rate is going to be 5.25% minimum. Recession probably is around the 30% level.

7:43: The WSJ ahead of the tape column is talking about the yield curve and recessions. This may be getting some play.